ÉCONOMIE

ÉCONOMIEDÉCRYPTAGES ÉCO

#66e8e1

ÉCONOMIE

De la crise de l’immobilier à la crise du logement Alexandre Mirlicourtois

25/04/2024

04:22

#66e8e1

ÉCONOMIE

Alerte rouge pour les élites et managers : l'IA menace votre expertise et votre légitimité Olivier Passet

24/04/2024

05:01

ÉCONOMIEINTELLIGENCE ÉCONOMIQUE

#66e8e1

ÉCONOMIE

Distribution print : les chiffres clés du marché des solutions d’impression Alexandre Masure

08/02/2024

03:02

#66e8e1

ÉCONOMIE

Le courtage en assurance : enquête sur le marché, ses mutations, les stratégies Jérémy Robiolle

09/01/2024

03:29

ÉCONOMIEINTELLIGENCE SECTORIELLE

#66e8e1

ÉCONOMIE

La révolution documentaire par l’intelligence artificielle Cathy Alegria

25/04/2024

03:14

#66e8e1

ÉCONOMIE

Photovoltaïque : Réinventer la compétitivité dans un modèle sans subvention Anne Césard

24/04/2024

03:16

#66e8e1

ÉCONOMIE

Les bachelors : aligner attractivité et qualité sans diluer la marque Anne Césard

19/04/2024

02:54

#66e8e1

ÉCONOMIE

Vin et spiritueux : réorganiser la supply chain face aux défis de l’e-commerce et de la durabilité Alix Merle

18/04/2024

04:05

ÉCONOMIELIBRE-PROPOS

#66e8e1

ÉCONOMIE

Pénuries de médicaments : le choc du collectivisme et du capitalisme Rémi Godeau

25/04/2024

04:30

#66e8e1

ÉCONOMIE

Pour une réglementation équitable dans l'économie numérique en Europe David Cayla

24/04/2024

03:47

#66e8e1

ÉCONOMIE

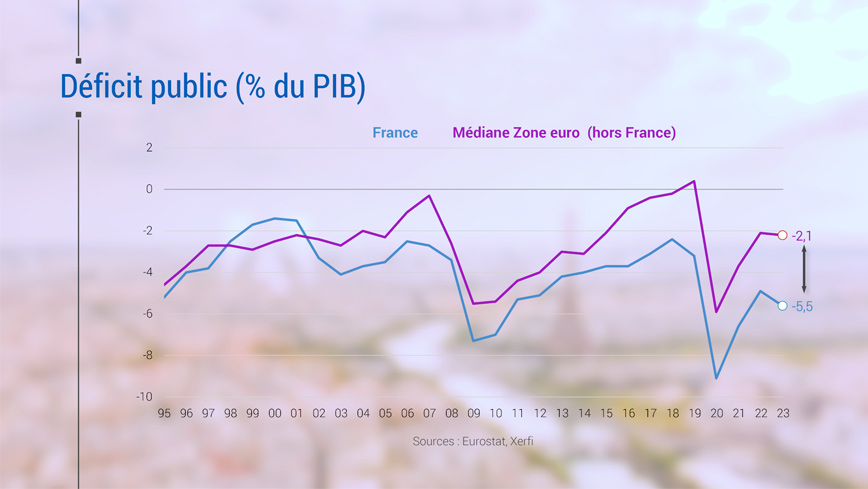

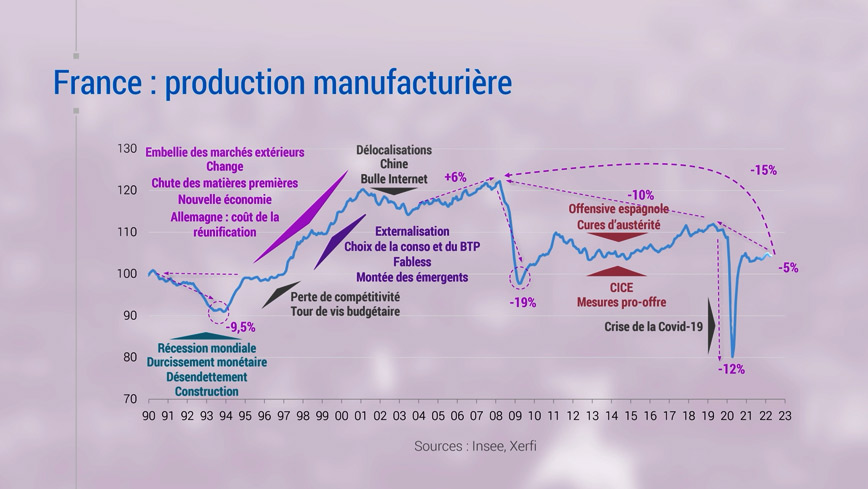

La zone euro, empêtrée dans une mortifère compétition interne Anaïs Voy-Gillis

23/04/2024

05:07

ÉCONOMIEPAROLES D'AUTEUR

#66e8e1

ÉCONOMIE

Les ambitions de la Chine dans le domaine monétaire et financier Michel Aglietta

20/04/2022

17:37

#66e8e1

ÉCONOMIE

Les Français attendent-ils vraiment un nouveau Bonaparte ? Guillaume Duval

05/01/2022

05:16

ÉCONOMIEGRAPHIQUES

#66e8e1

ÉCONOMIE

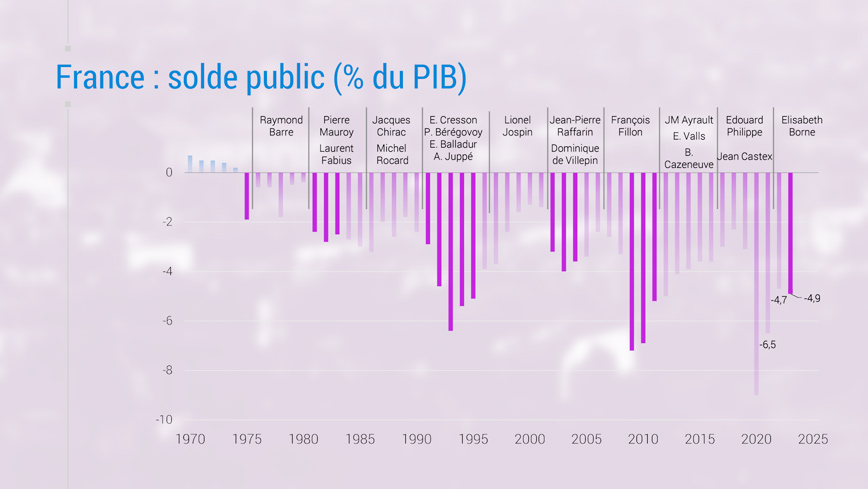

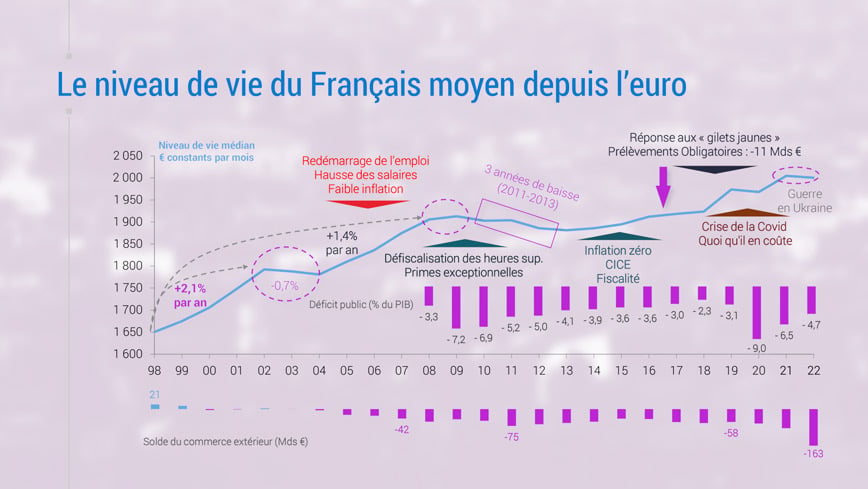

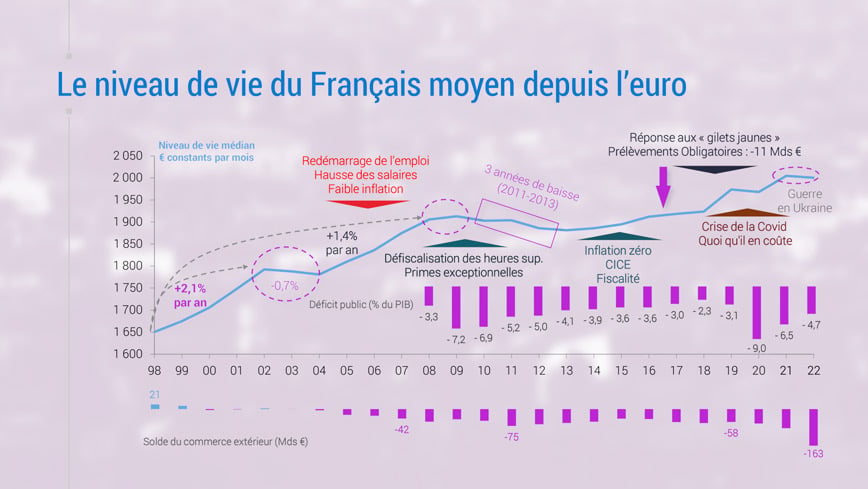

La spirale infernale du soutien au pouvoir d'achat en France Le-graphique

02/06/2023

05:25

ÉCONOMIENOTES DE LECTURE

#66e8e1

ÉCONOMIE

Inégalités et populisme : le temps des passions tristes Thibault Lieurade

04/06/2019

03:19